Trade Journal in Stolo

Successful trading isn’t only about making the right entries, it’s about learning from bad ones too. That’s where the Trade Journal in Stolo comes in. Whether you’re an active options scalper or a strategy-based trader, the journal gives you the visibility needed to build consistency and discipline. Most importantly, a space to reflect all within the same place where you took trades.

No more scattered notes or Excel files. Review your trades directly within the platform where you made them.

What Is the Trade Journal?

The Trade Journal is a personal dashboard that automatically records:

- Each trade you execute through Stolo

- Entry and exit time

- Trade type (CE/PE/Futures)

- Price, quantity, and instrument

- P&L and MTM at the time of close

- Greeks snapshot (Delta, Theta, Vega, Gamma)

- Payoff view if placed via Strategy Builder

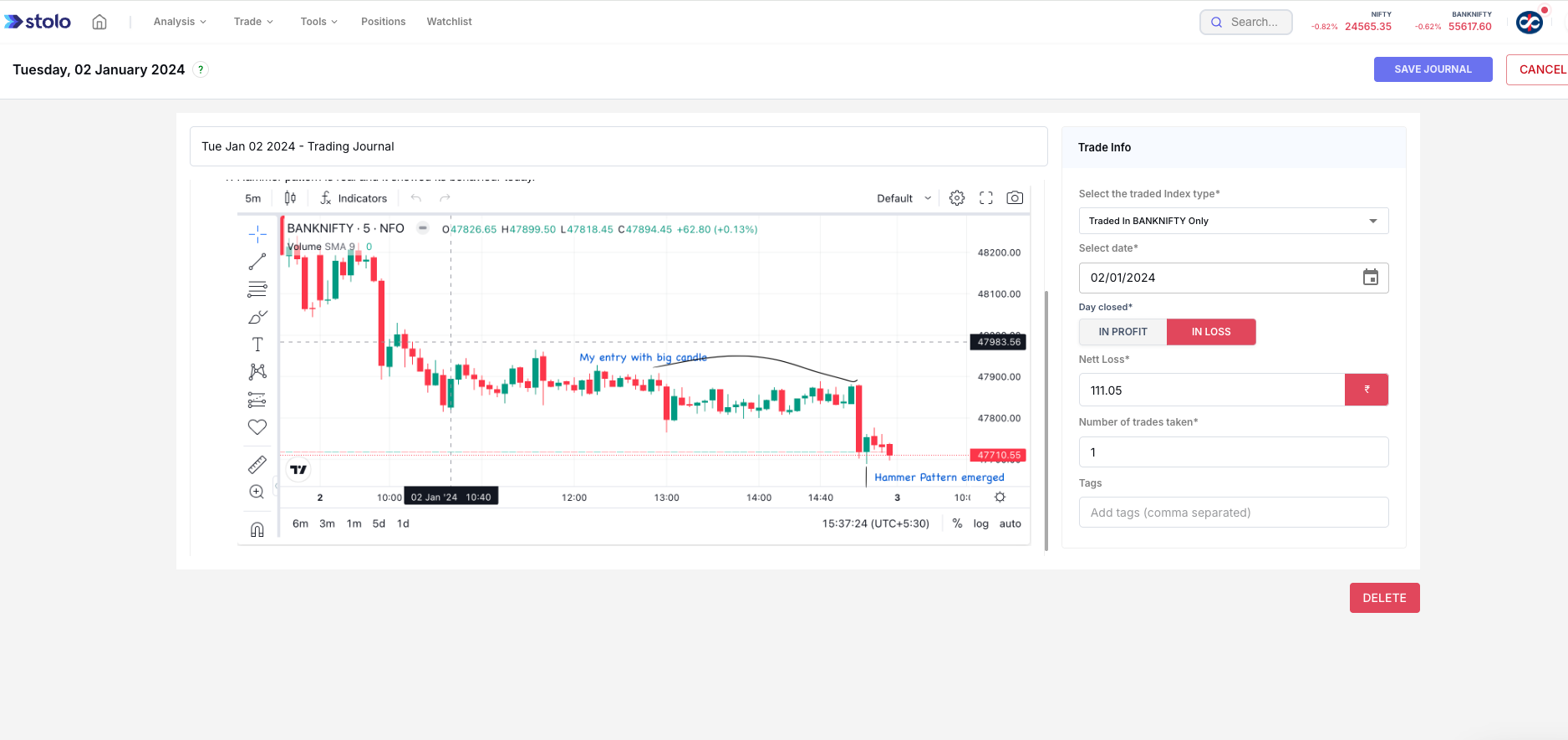

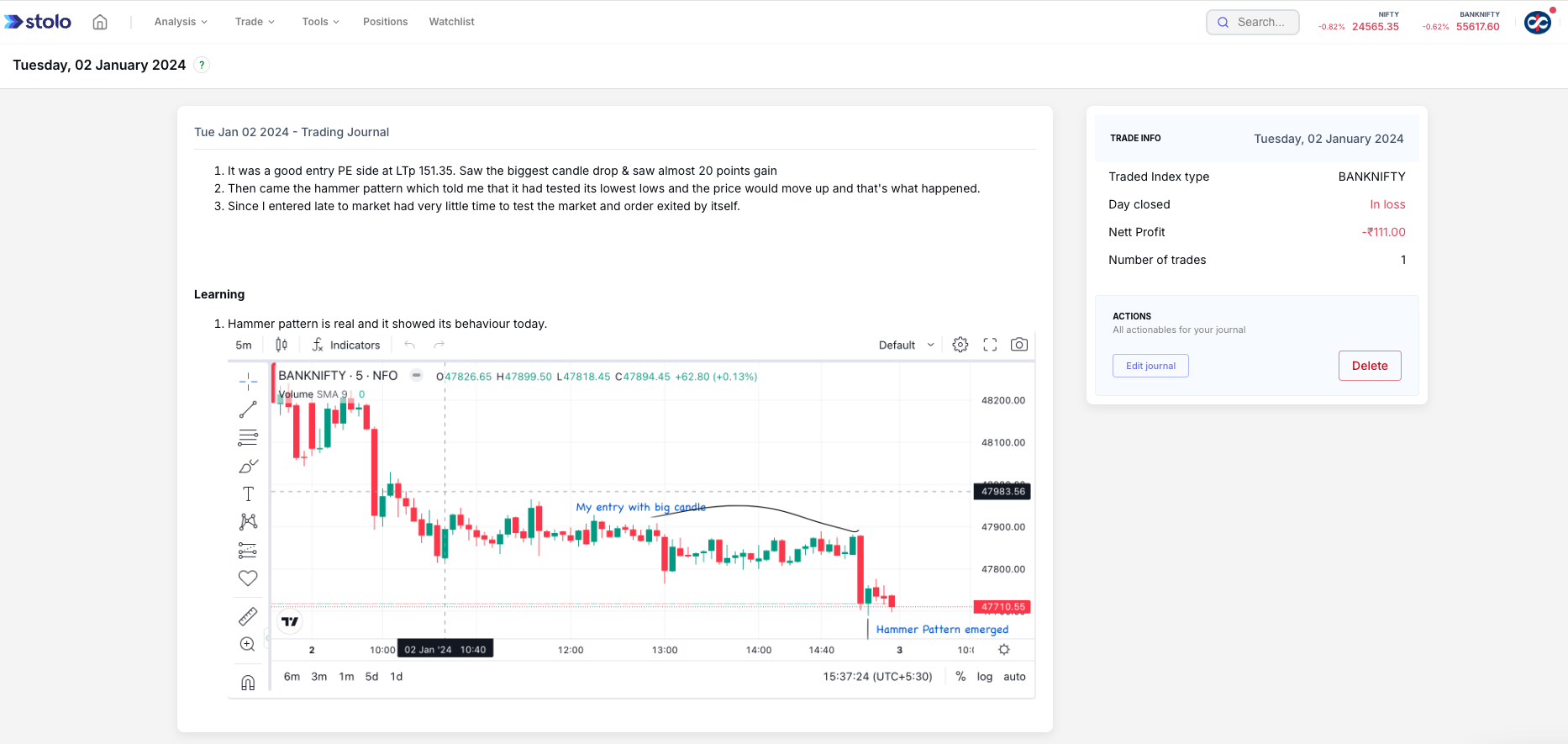

You can also manually add notes, such as what your thesis was, why you entered, and how you felt before/after the trade. It’s a space to be honest with your trades so you can get better with every session.

Why Use a Trade Journal?

- See patterns in your winning and losing trades

- Understand if your losses come from strategy, execution, or emotion

- Build data around your personal trading behavior

- Improve decision-making by reflecting on past setups

How to Access It

- Go to the “Trade Journal via Tools in main menu” section from your dashboard

- You would see list of trades taken by you for the date filter you have set on the screen

- The chart represents profit/loss made

- The list represents individual trades for you to reflect on each.

- Click on any trade to open its full breakdown to see attached reflection on it.

- You can click on Edit Journal to edit or update your reflections

All trades placed via connected brokers through Stolo get logged automatically.