Types of Strategies in Stolo

Stolo’s Strategy Builder supports a wide range of pre-defined and custom options strategies. Whether you’re expecting a strong trend, range-bound movement, or volatility, Stolo helps you choose the right setup with clarity.

Let’s explore the types of strategies you can create and analyze in Stolo.

Bullish Strategies

Use these when you expect the market to move upward.

Long Call Buy a Call Option to benefit from rising prices. The Long Call is one of the simplest bullish strategies. Here, the trader buys a Call option, expecting the price of the underlying asset (like Nifty or Bank Nifty) to rise sharply before expiry. It gives the buyer the right, but not the obligation to buy the asset at a fixed strike price.

This strategy is popular because the maximum loss is limited to the premium paid, while the potential profit is theoretically unlimited as the price rises. It’s best used when you're confident about a strong upward movement in the market within a limited timeframe.

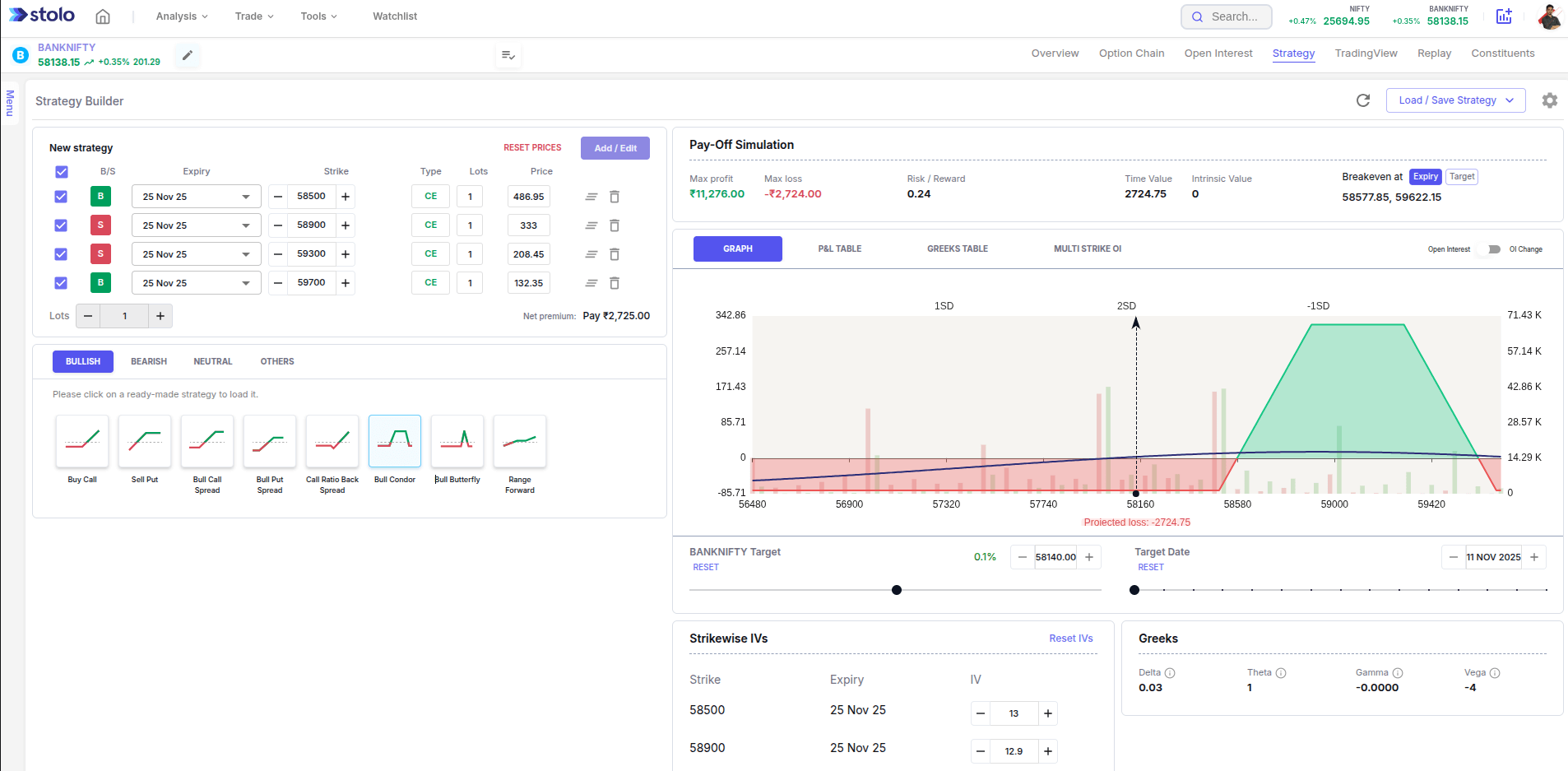

Bull Call Spread Buy one Call, Sell a higher strike Call limited risk and reward.A Bull Call Spread is a defined-risk bullish strategy created by buying a Call at a lower strike and simultaneously selling another Call at a higher strike. Both options belong to the same expiry.

This strategy reduces the upfront cost (compared to a Long Call alone), but it also caps the profit potential. It’s useful when you’re moderately bullish and expect the market to rise up to a certain level not beyond. It works well when you want to limit both risk and reward.

Short Put Sell a Put to benefit from upward or sideways movement (requires margin). In a Short Put strategy, the trader sells a Put option, betting that the price of the underlying will stay above the strike price. The idea is to earn a profit from the premium received as long as the market stays flat or moves slightly upward.

While this strategy provides a fixed reward (the premium), the risk is significant if the market falls sharply since the seller may be obligated to buy the asset at a higher strike. It’s often used by experienced traders who have a bullish-to-neutral outlook and enough margin to cover potential losses.

Put Ratio Spread Sell multiple puts and buy one bullish bias with limited loss if the market falls moderately. This is a more advanced bullish strategy. A trader sells more Puts than they buy typically selling two OTM Puts and buying one ATM Put. This creates a net credit position with limited downside risk.

Put Ratio Spreads benefit from sideways to mildly bullish markets, and even allow for some downside movement. However, a sharp fall in the underlying may cause losses beyond the breakeven zone. It’s a flexible play for traders who want to profit from time decay and expect consolidation or moderate upside.

Bearish Strategies

Use when you expect the market to fall.

Long Put Buy a Put Option to profit from downward movement.The Long Put strategy is a straightforward bearish position where the trader buys a Put option, expecting the underlying asset to drop significantly before expiry. It gives the right to sell the asset at a fixed strike price.

This strategy offers unlimited profit potential (as the underlying price drops toward zero) while limiting the maximum loss to the premium paid. It’s an ideal strategy for traders who want to benefit from downside movement without taking on undefined risk especially during weak market trends or after negative news.

Bear Put Spread Buy a Put, Sell a lower strike Put, limited loss and profit. A Bear Put Spread involves buying a Put at a higher strike and selling another Put at a lower strike, both with the same expiry. This structure reduces the upfront premium compared to a plain Long Put but also limits the profit potential.

It’s a good choice when you expect the market to decline gradually rather than crash. The short leg of the spread helps recover some premium, making it more cost-effective than a Long Put, but it caps profits beyond the lower strike.

Short Call Sell a Call to gain if the market stays flat or drops (requires margin). In a Short Call strategy, the trader sells a Call option, expecting the market to remain flat or fall. The goal is to earn the premium as profit if the price stays below the strike price of the sold call.

While the strategy provides a fixed income, the risk is unlimited especially if the market rallies sharply since the call seller might be obligated to sell the asset at a lower price. It’s typically used by experienced traders with a bearish or neutral outlook, who can manage margin and risk exposure.

Call Ratio Spread Sell multiple calls and buy one bearish to neutral view with limited upside risk.

The Call Ratio Spread is a bearish-to-neutral strategy where the trader sells more Call options than they buy, usually selling two OTM Calls and buying one ATM or ITM Call. This creates a net credit position that benefits from time decay and limited upside moves.

The strategy works well in a range-bound or slightly bearish market, but can result in losses if the market rises sharply past the breakeven zone. It's often used by traders who expect a mild upside move or consolidation and want to collect premium with controlled risk.

Neutral Strategies

Use when you expect the market to stay within a range.

Short Straddle Sell ATM Call and Put which earns a premium if the market stays flat. In a Short Straddle, the trader sells both a Call and a Put option at the same strike and expiry — typically ATM (At The Money). The idea is to profit from the lack of movement in the underlying asset, as both options lose value over time.

This strategy earns the maximum premium when the market stays flat, but involves unlimited risk on both sides if there’s a breakout. It’s suitable for highly experienced traders who are confident the market will remain range-bound and are comfortable with high-risk/high-reward setups.

Short Strangle Sell OTM Call and Put, wider range, lower reward, less risk. The Short Strangle is a more flexible version of the straddle. The trader sells an OTM Call and an OTM Put with the same expiry.

This strategy gives a wider breakeven range, making it slightly safer than a straddle, though the premium collected is lower. It's designed to profit from sideways movement and time decay, with risk exposure still present on both sides if there’s a sharp move. Many traders prefer strangles during low volatility conditions.

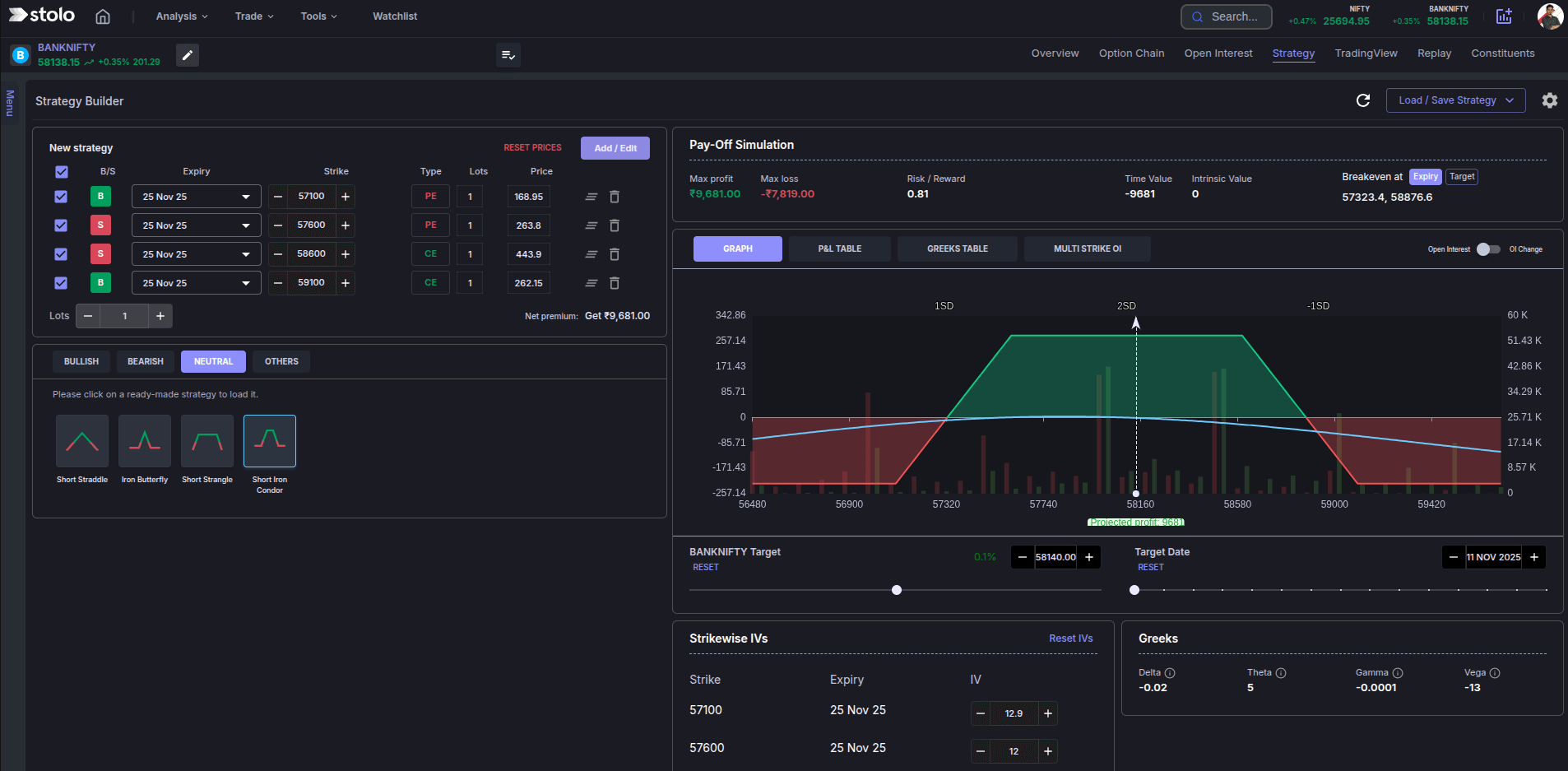

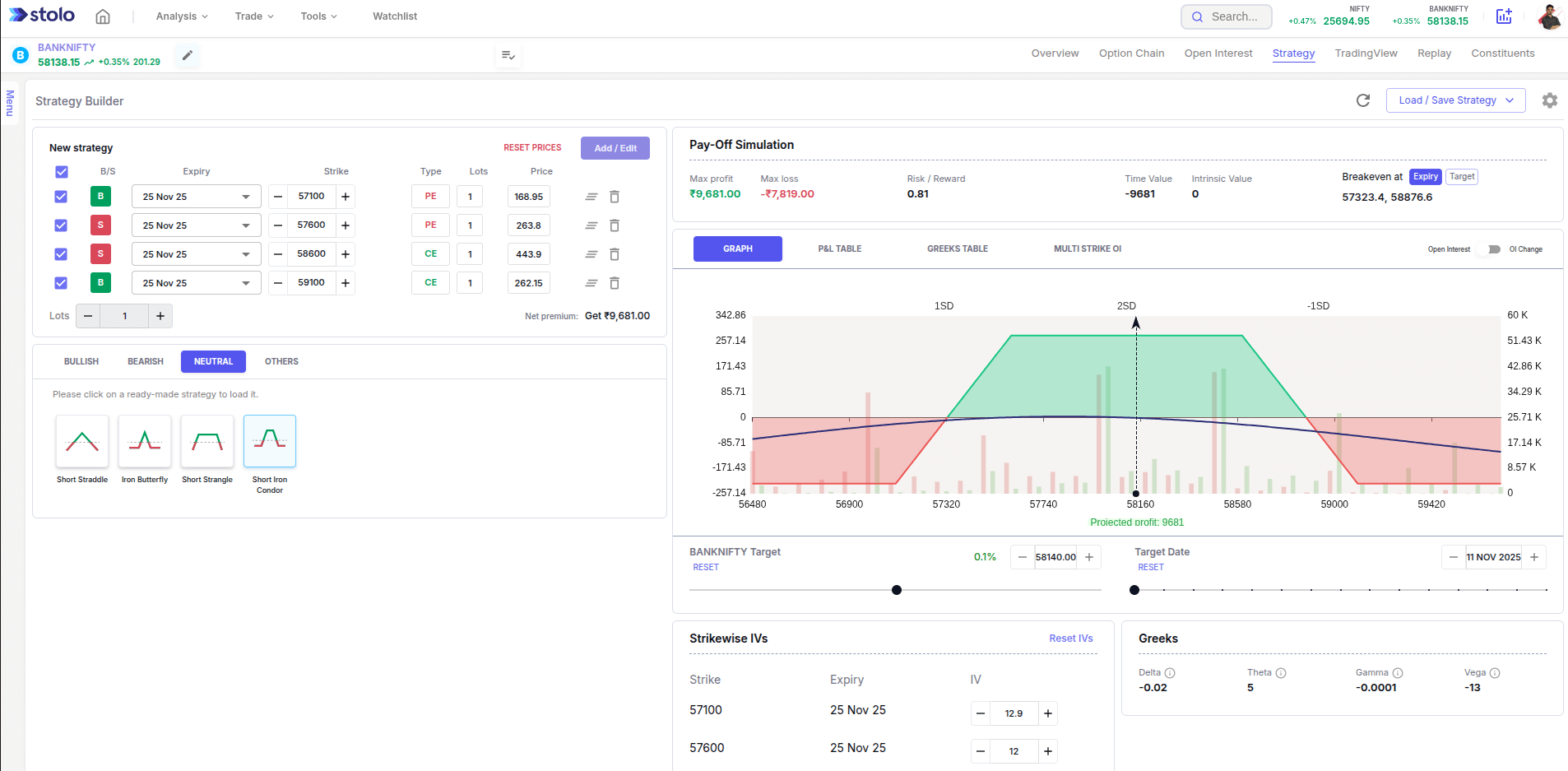

Iron Condor Sell a Strangle & hedge with further OTM options defined risk and reward. The Iron Condor is a defined-risk, neutral strategy that combines a short strangle with further OTM hedges. It involves selling one OTM Call and one OTM Put, and buying another further OTM Call and Put as protection.

This strategy profits from a market that stays within a well-defined range and is popular for its limited risk and reward structure. It's ideal for conservative traders seeking to benefit from time decay and low volatility environments.

Butterfly (Call/Put) Low-cost neutral strategy with profit if the index stays near the central strike. A Butterfly Spread is a low-cost, range-bound strategy that profits when the underlying expires near a chosen strike.

It typically involves buying one option at a lower strike, selling two at the middle strike, and buying one at a higher strike (or vice versa). It has a low cost of entry, limited risk, and defined reward, but only performs well if the price ends up very close to the middle strike. This strategy is for traders who want to bet on very low volatility or expiry pinning around a strike.

Other Strategies / Advanced

For volatility, events, or custom setups.

Long Straddle In a Long Straddle, the trader buys both a Call and a Put at the same ATM strike, betting on high volatility. The idea is that a strong move in either direction will result in profit, while the downside is limited to the combined premiums.

This is a good strategy ahead of major events (like budget announcements or Fed meetings), where traders expect a move but aren’t sure which way. The key is that the move must be big enough to overcome the cost of both premiums.

Long Strangle The Long Strangle is a cheaper alternative to the Long Straddle. It involves buying an OTM Call and an OTM Put. Since both options are cheaper than ATM, the total cost is lower — but the move required to profit is larger.

It’s best used when you expect a significant move but want to reduce your initial outlay. Like the straddle, the risk is limited to the premium paid, and the reward is potentially unlimited.

Calendar Spread Buy long-dated options, sell near-dated used to capture time decay. A Calendar Spread involves buying a long-dated option and selling a short-dated option of the same strike and type (both Calls or both Puts). This strategy profits from time decay in the near option while maintaining exposure in the longer one.

It’s typically used to exploit volatility differences between expiries and works well in range-bound conditions where the trader expects minimal price change in the short term.

Custom Multi-leg With Stolo’s Strategy Builder, you can create fully customized strategies by combining any number of legs calls and puts, across strikes and expiries. This flexibility allows traders to design setups tailored to their view, volatility expectation, and capital allocation.

Whether you’re combining an Iron Fly with a protective leg or building your own directional hedge, custom strategies let you execute your unique trading ideas with full payoff and margin visibility.

Choosing the Right Strategy

When choosing a strategy, as a trader you should first have answers to these questions:

- What's my market view — bullish, bearish, sideways?

- Do I want defined risk or higher reward?

- How much margin and capital do I want to deploy?

- What's my timeframe — intraday, weekly, or positional?

Stolo helps you answer these by providing data across:

- Payoff chart

- Greeks

- Margin required

- Max profit/loss and breakeven

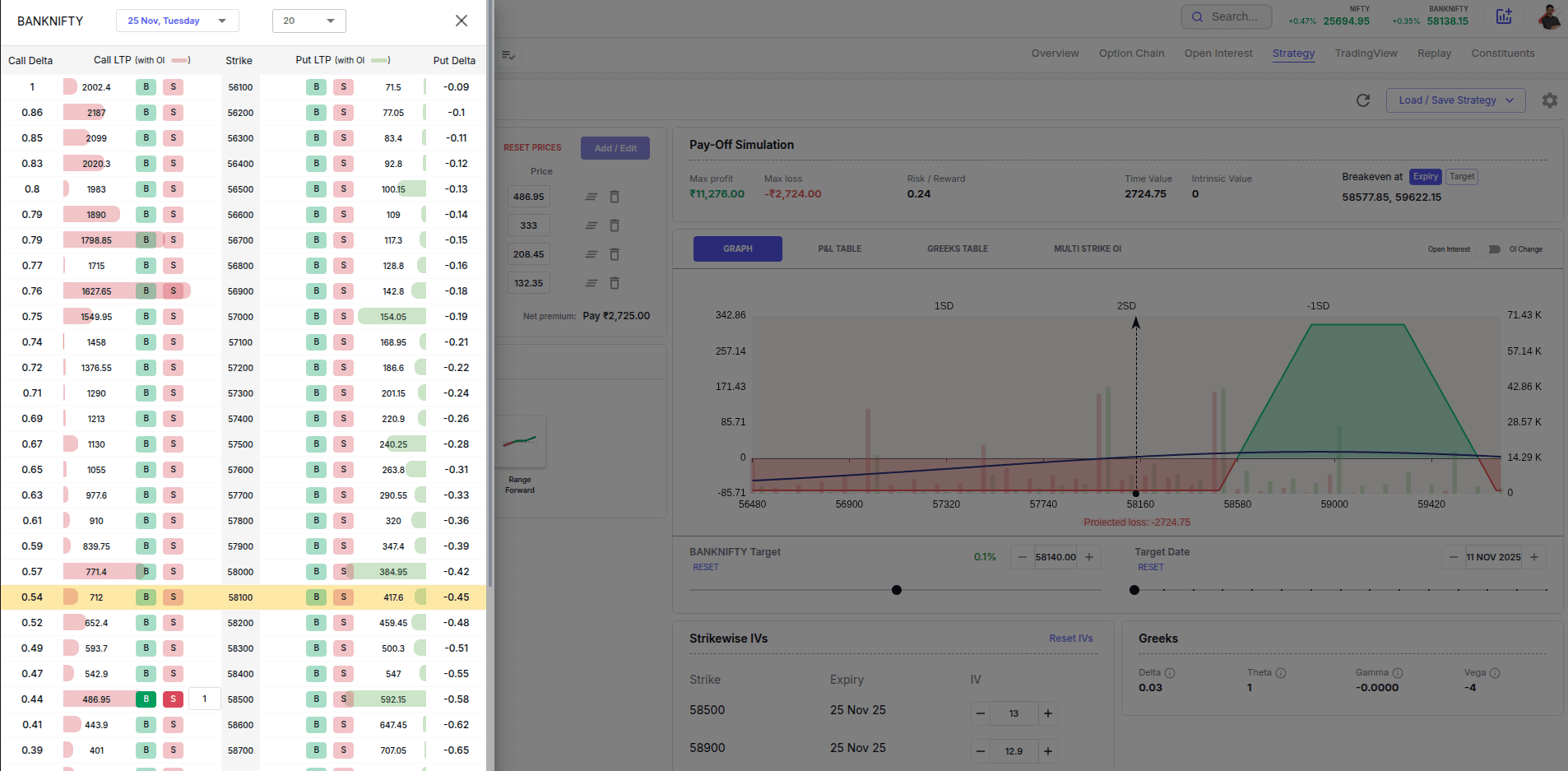

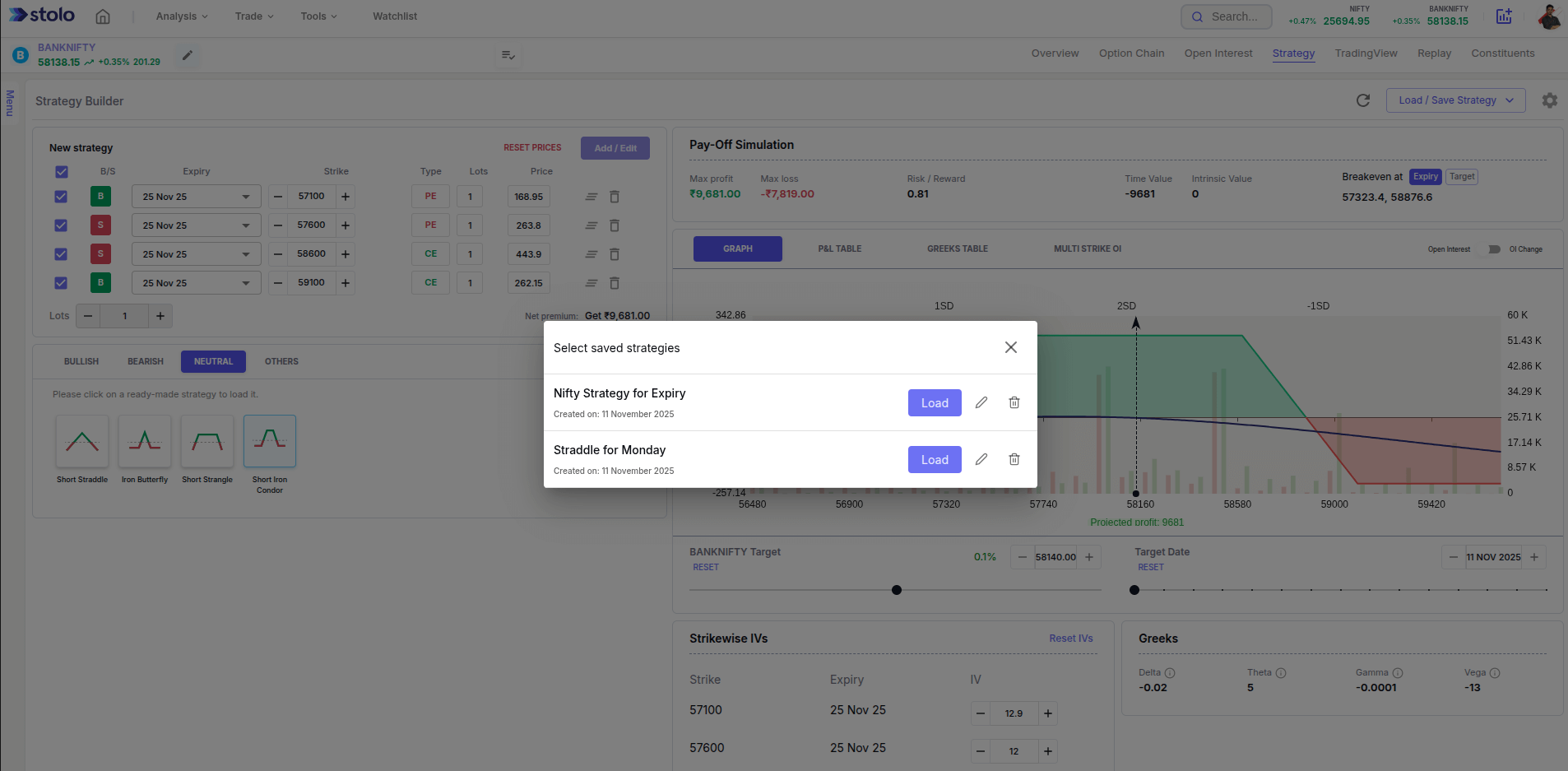

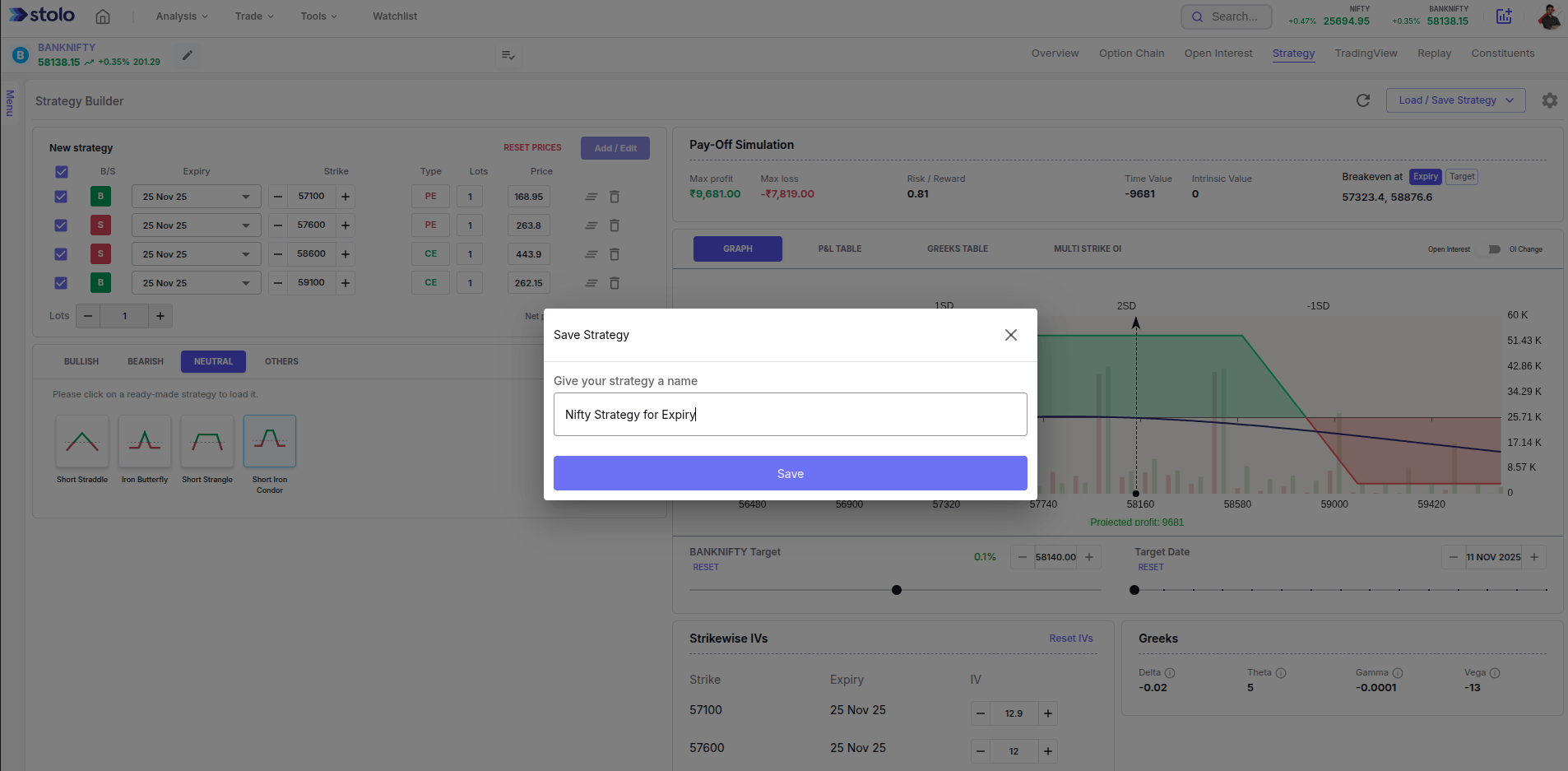

Try It in the Strategy Builder

Go to Strategy Builder from the menu, choose Pre-Built Strategy based on your market view and other parameters. You may also filter by outlook: Bullish / Bearish / Neutral / Others

Customize, visualise and replicate it in the trading terminal of your choice.

Requires broker connection for trading & is available in Trial & Pro Plans. Signup Now